Q: Hey, I’m an artist and I have just done my taxes… but now I’m scared that I have done them wrong and the tax man is going to come and get me. Can you please advise me!

Let’s do it. A quick 101 for artists on self-employment because let’s be real, it’s not like art schools ever teach such genuinely useful things.

Rather than being employed by a company who would give you a contract, a regular payslip, benefits, a pension contribution and so on, most artists are self-employed. They work for themselves and are responsible for the terms of that work.

Apologies in advance to readers from America and other spots around the globe who face their own flavour of tax nightmares. We can really only offer specific advice based on our own experiences in the UK, but hopefully there’ll still be some general nuggets here about income and expenditure that might help you.

If you are earning more than £1,000 a year for your work as an artist, you need to register as self-employed with HMRC. You can do this on the GOV.UK website. It’s worth noting that you can be self-employed and regularly employed at the same time. The tax portal will automatically record earnings from your employment, which is handy, so it’s just up to you to input your extra-curricular stuff.

“Let’s be real, it’s not like art schools ever teach such genuinely useful things”

Once registered, HMRC will give you a Unique Taxpayer Reference which is the reference number you file on your tax returns every year. Tax years are a bit funny because the dates are on a wonk. It runs from 6 April to 5th April (365 days in a non-leap year), and the deadline for filing is on 30 January the year after.

So for the 2021-22 tax year, the dates you’d need to submit tax info for is: 6 April 2021 until 5 April 2022, and the deadline for that return will be 30 January 2023. You can go ahead and ask an accountant to file your return for you or do it yourself.

In the tax return, HMRC asks for two main bits of information: the amount of money you made through work, and the amount of money you spent in order to make that work happen. The first is relatively easy: go through invoices and bank transactions and add the income up.

The second part of this can be a faff but you can make it smoother for yourself if you keep track of expenses as you go. The tax return then takes money earned, takes off the money spent, and calculates your total profit. The profit determines how much tax you have to pay.

The more money you had to spend, the lighter this figure will be. And I’m just underlining that because artists tend to miss things they could definitely declare as an expense. The work of an artist is so sprawling that this expense list can be long and weird and varied. Artists might list: materials, equipment, work-related travel, business meals, advertising, and research that could take the form of books, conferences, gallery tickets and so on.

More and more, people are spending money on memberships. These might be for in-person gallery visits or libraries, or software memberships such as Adobe or Canva, to name a few. There’s also the costs of having a studio in rent, utilities, furniture. Artists are also allowed to determine a figure for home utilities based on the percentage of phone and Internet they believe they use for work purposes.

“The work of an artist is so sprawling that this expense list can be long and weird and varied”

If you are an artist that sells things online, you can also add up processing fees for Paypal or Etsy and the like. If you do pay an accountant to do your tax return, you can write them off on it as well.

Anything you need for your business is a valid expense, you just have to keep track of everything so you don’t forget. Practically speaking, we do this in a fairly simple way. We have a basic spreadsheet with four columns for date, description, money in, money out. I double-check everything by going through my bank statements from 6 April to 5 April the following year.

I rarely ever spend cash but if I do I keep the receipt and make sure I add it into the spreadsheet too. You have to keep your receipts in a safe place though as, according to HMRC, “You should keep your records for at least 22 months after the end of the tax year the tax return is for.” This is in case they want to question you about something but hopefully everything is fine.

That’s kind of all there is to it. It’s fairly simple when it comes down to it, it just feels scary and enormous from the outside. The website explains every step of the way, does all the calculating for you and most of the confusing questions won’t apply. And don’t forget: while the deadline for the return and all payment owing might be 30 January of the next year, you can actually fill in your tax return at any point after the 5 April date. So don’t leave it too late because if you’re stressed by a looming deadline, then that’s when you might make mistakes.

Culture Therapy: Let Art Solve Your Problems

At the end of our advice column, we usually give you a film to watch or an artwork to think about, a present to leave with on your way out the door. It’s a bit tricky to prescribe you anything interesting following a piece about how self-employment works though.

Plus, I can’t stop thinking about Lorraine Kelly’s fight with both ITV and HMRC over her status as a freelancer, how Lorraine is actually a character she performs and not simply herself. So, before I link you to an article about that debacle, I’m going to link you to something nice instead.

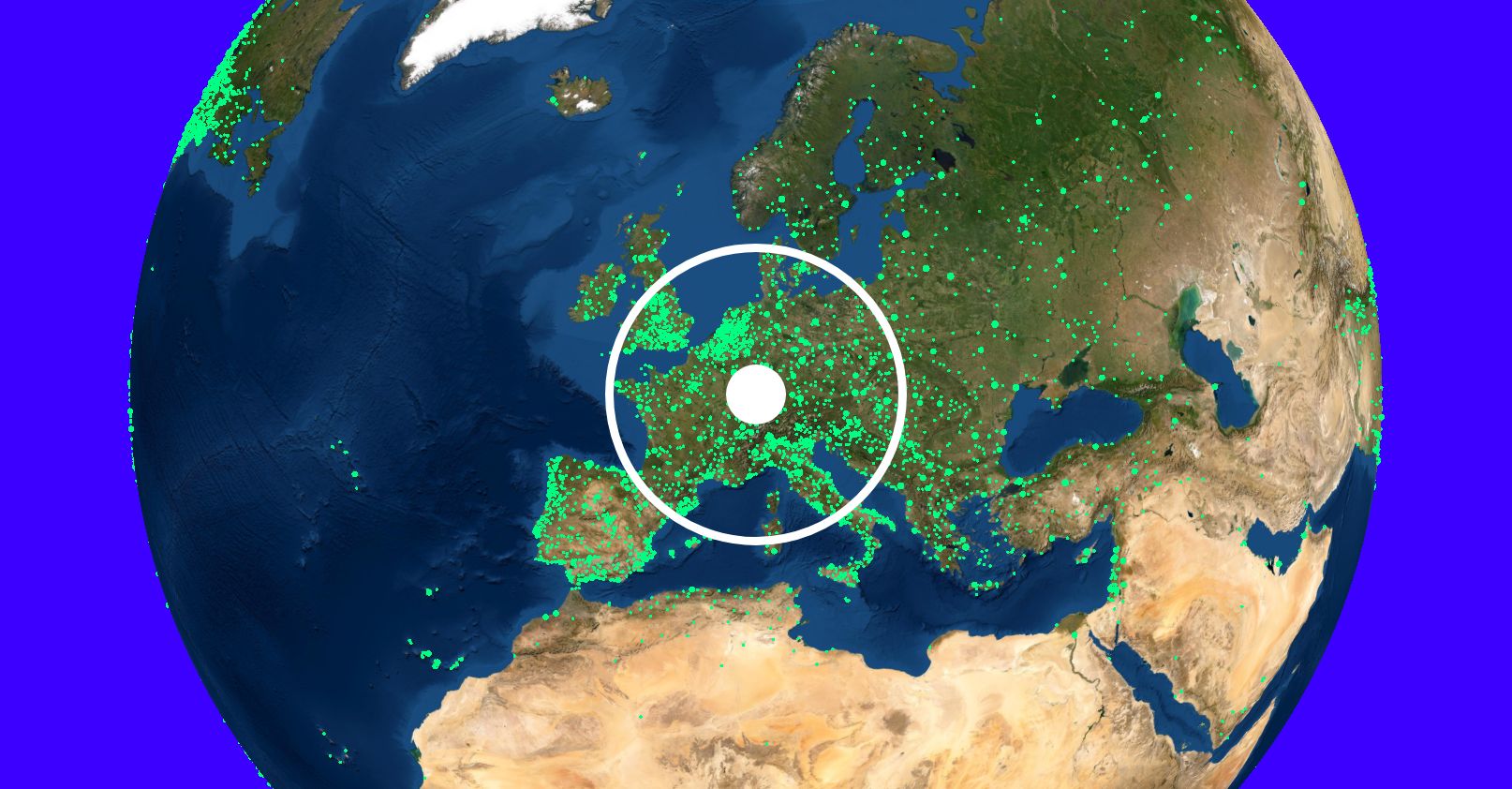

Radio Garden is a delightful website where you can spin a globe and tune into the radio stations anywhere around the world. I listened to it while I was filling in my tax return this year so maybe it will be good company while you’re getting on with yours.

Illustration by Lucia Pham, an illustrator based in Hanoi

Have a question for The White Pube?

Get in touch with Zarina and Gabrielle at info@thewhitepube.com

GET IN TOUCH